self employment tax deferral covid

Self-Employed Coronavirus Relief Center. Under the covid-related tax relief act of 2020 employers are not required to provide paid sick and family leave to employees after december 31 2020.

Payroll Tax Deferral Provided By Cares Act Advisory Services Uhy

Self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401 a of the Internal Revenue Code on net earnings from.

. Tax Relief for Self-Employed and Small Businesses Under the Families First Coronavirus Response Act The Families First Coronavirus Response First Act which was. Many small business owners and self-employed individuals have been affected by Coronavirus COVID-19. Heres what tax relief is available under the major coronavirus relief legislation.

If youre self-employed the coronavirus COVID-19 pandemic is likely impacting your business. The Social Security portion of self-employment tax is 124 of taxable income. The COVID-related Tax Relief Act of 2020 enacted December 27 2020 amended and extended the tax credits and the availability of advance payments of the tax credits for paid sick and.

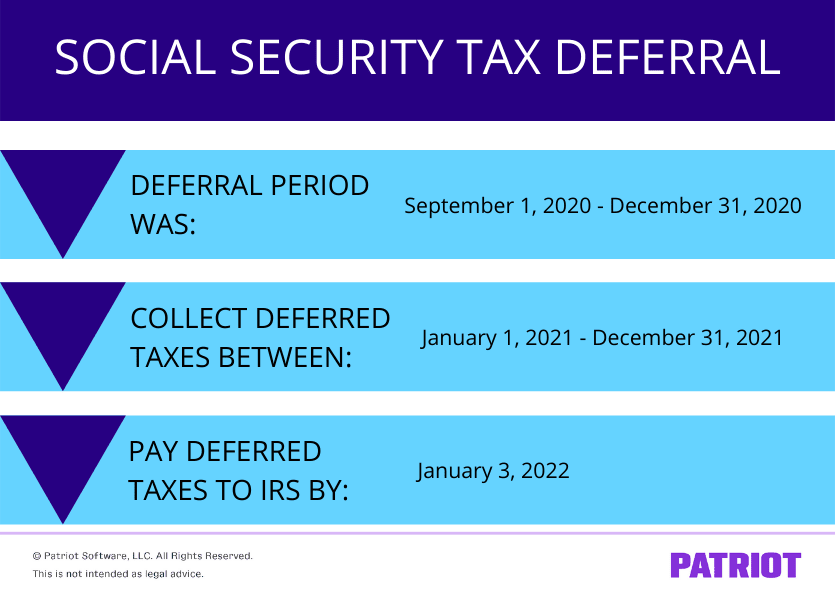

According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401 a of the Internal Revenue Code on net. Self-employed taxpayers can defer. The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on their Form 1040.

Multiple their taxable income for the eligible period by 062. An Affected Taxpayer employer may defer the withholding and payment of Applicable Taxes employee share of FICA on Applicable Wages less than 4000 paid per. Request for Taxpayer Identification Number TIN and Certification Form 4506-T Request for Transcript of Tax Return Form W-4 Employees Withholding Certificate Form 941 Employers Quarterly Federal Tax Return Form W-2 Employers engaged in a trade or business who pay compensation Form 9465.

The provision let you defer payment of the employer. Estimate how much cash you. The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the payment of certain Social Security taxes on.

As part of the COVID relief provided during 2020 employers and self-employed people could choose to put off paying the employers share of their eligible Social Security tax. Nearly all businesses and self-employed individuals were eligible for the employer payroll tax deferral. You can reasonably allocate 77500 775 x 100000 to the deferral period March 26 2020 to December 31 2020.

Following some initial confusion HMRC has now updated its advice for businesses and individuals affected by coronavirus to make clear that the six-month income tax self. The Families First Coronavirus Response Act FFCRA provides refundable credits worth up to 15110 to self-employed individuals who lost income due to COVID-19. As a self-employed individual only 9235 of your.

The FFCRA passed in March 2020 allows eligible self-employed individuals who due to COVID-19 are unable to work or telework for reasons relating to their own health or to. The Coronavirus Aid Relief and Economic Security Act CARES Act allowed self-employed individuals to defer payment of certain self-employment taxes on income subject to.

How Self Employed Individuals And Household Employers Can Repay Deferred Social Security Tax Tax Pro Center Intuit

Self Employed Social Security Tax Deferral Repayment Info

Cares Act Payroll Tax Deferral For Employers

What The Self Employed Tax Deferral Means Taxact Blog

Us Deferral Of Employee Fica Tax Help Center

Employee Social Security Tax Deferral Guidance Too Little Too Late

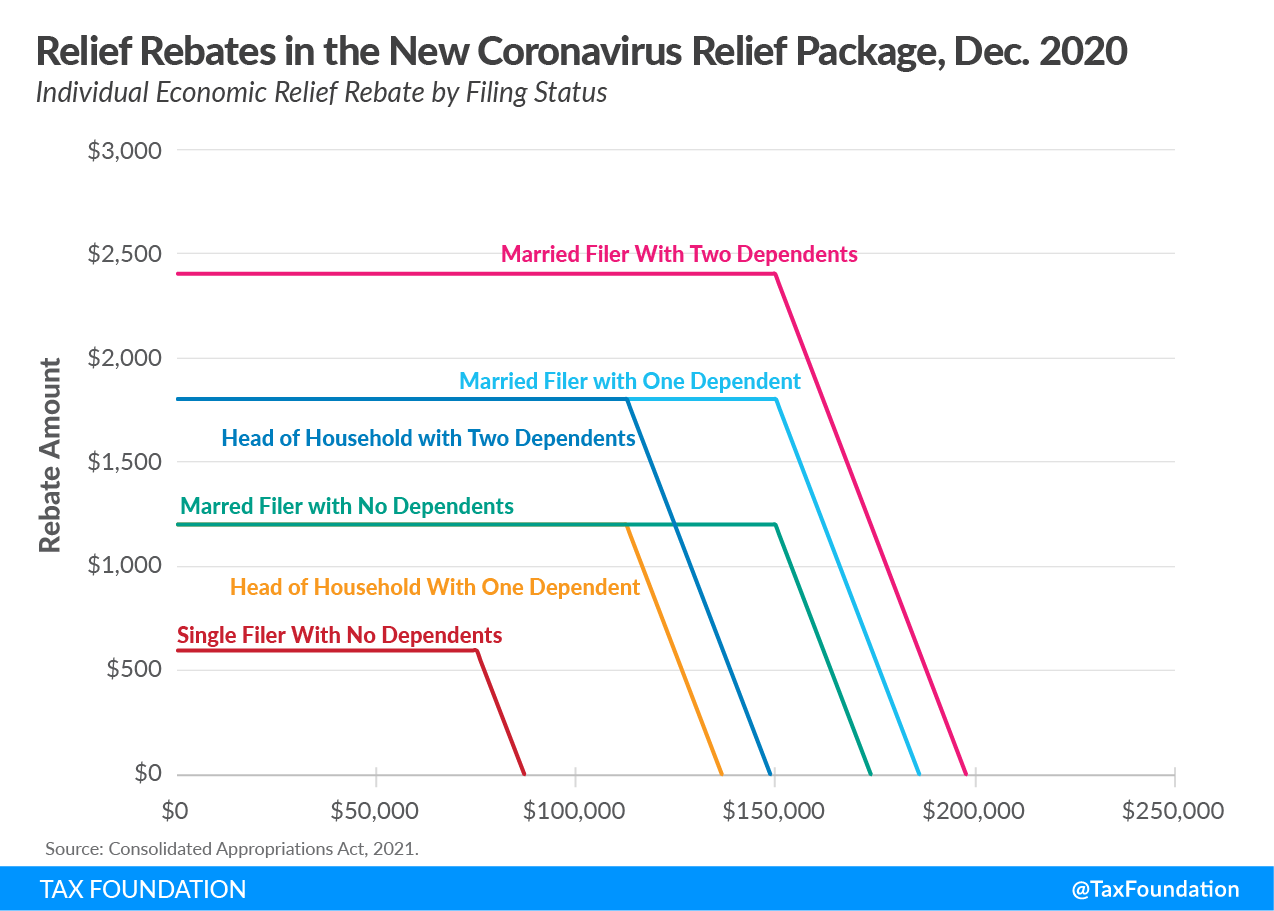

Coronavirus Relief Package 600 Stimulus Check 300 Unemployment

Irs Issues Guidance On Repayment Of Deferred Payroll Taxes Accounting Today

Hello Everyone I M Filing My Taxes For 2020 With Turbotax And They Are Asking Me To Check This Entry I Don T Really Understand What I Should Put Here R Tax

Employee Social Security Tax Deferral Repayment Process

Employee Social Security Tax Deferral Repayment Process

Cares Act Provisions For Financial Advisors And Their Clients

7 Cares Act Tax Breaks For Businesses Kiplinger

5 Ways To Defer Tax Payment Obligations For Employers

Irs The Coronavirus Aid Relief And Economic Security Act Allowed Self Employed Individuals And Household Employers To Defer The Payment Of Certain Social Security Taxes On Their Form 1040 For Tax Year

Cares Act Tax Relief Nol Carryforwards Atlanta Tax Firm

Guidance On Deferred Employee Payroll Tax Issued Journal Of Accountancy